Executive Summary

Asset management is the systematic process of developing, operating, maintaining, and upgrading assets in a cost-effective manner. It encompasses financial assets like stocks, bonds, and investment portfolios, as well as physical assets such as machinery, real estate, and infrastructure. The primary goal is to maximize value, minimize risks, and ensure that resources are used efficiently throughout their lifecycle.

Organizations, investors, and individuals use asset management strategies to achieve financial growth, maintain operational efficiency, and safeguard long-term sustainability. This guide explores asset management principles, processes, types, tools, benefits, challenges, and real-world applications.

Table of Content

Introduction

In today’s complex economic environment, the value of assets extends far beyond mere ownership. Effective management ensures that assets generate returns, remain functional, and align with strategic objectives. Whether it’s managing a corporate investment portfolio or maintaining a city’s infrastructure, asset management provides a framework for decision-making, risk mitigation, and value optimization.

Asset management is both an art and a science. It combines financial acumen, operational insight, and risk management strategies to deliver sustainable results.

The Origins of Asset Management

The concept of asset management has evolved over centuries, from basic wealth stewardship to sophisticated financial and operational systems.

Key Milestones:

- Early Wealth Management – Wealthy individuals and families historically relied on advisors to manage estates, land, and financial assets.

- 20th Century Investment Management – The growth of financial markets led to professional portfolio management firms and institutional investors.

- Modern Asset Management – Today, asset management integrates technology, data analytics, and advanced strategies to optimize performance across financial and physical assets.

Core Principles of Asset Management

Asset management is guided by several foundational principles:

- Value Optimization – Maximizing returns or performance relative to cost.

- Risk Management – Identifying, assessing, and mitigating potential losses or operational failures.

- Lifecycle Approach – Managing assets from acquisition through operation, maintenance, and disposal.

- Transparency and Accountability – Ensuring stakeholders have clear information about asset performance and management decisions.

- Alignment with Strategic Goals – Ensuring asset decisions support broader organizational objectives.

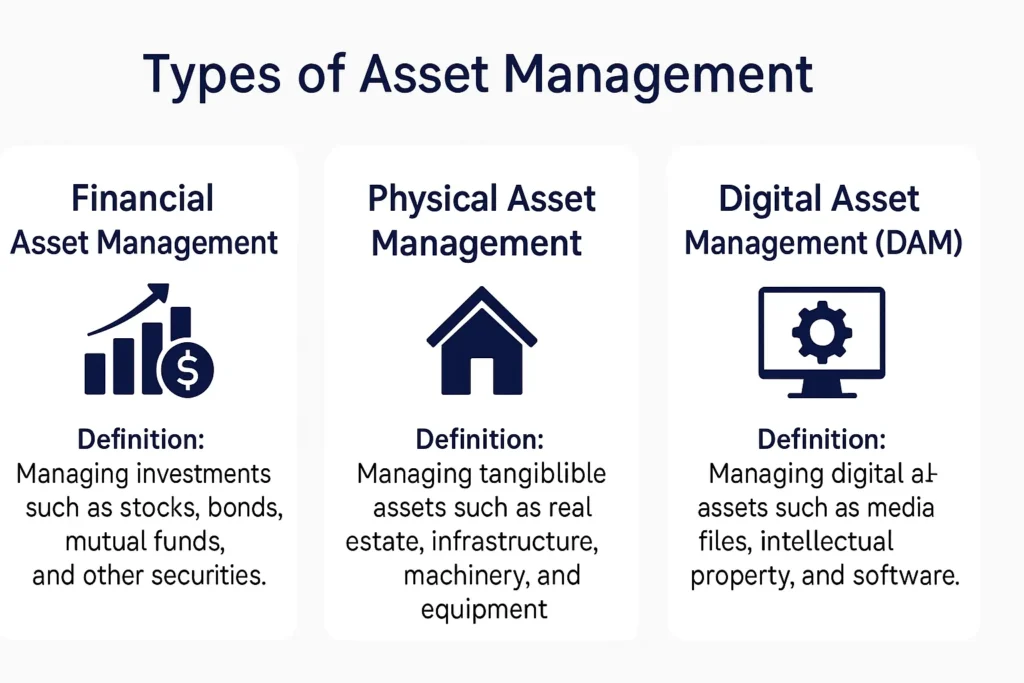

Types of Asset Management

Asset management can be broadly categorized into financial and physical asset management.

1. Financial Asset Management

- Definition: Managing investments such as stocks, bonds, mutual funds, and other securities.

- Purpose: Maximize returns, manage risk, and meet investment objectives.

- Key Players: Asset management firms, mutual funds, hedge funds, and individual investors.

- Techniques: Portfolio diversification, risk-adjusted returns, market analysis, and performance monitoring.

2. Physical Asset Management

- Definition: Managing tangible assets such as real estate, infrastructure, machinery, and equipment.

- Purpose: Extend asset life, reduce downtime, and ensure operational efficiency.

- Key Practices: Preventive maintenance, condition monitoring, replacement planning, and capital investment planning.

3. Digital Asset Management (DAM)

- Definition: Managing digital assets such as media files, intellectual property, and software.

- Purpose: Organize, secure, and optimize the use of digital resources.

- Techniques: Metadata tagging, version control, access management, and cloud storage solutions.

Related Articles to Explore

Asset management connects closely with financial, operational, and risk management practices. Explore these related guides:

- What Is Risk Management? – Learn how identifying and mitigating risks protects valuable assets.

- What Is Wealth Management? – Discover how managing assets strategically ensures long-term financial growth.

- What Is Business Management? – Understand how organizational strategies impact effective asset utilization.

- What Is Operations Management? – See how operational efficiency supports the proper use and maintenance of assets.

- What Is Supply Chain Management? – Explore how asset management ensures smooth logistics and resource allocation.

Asset Management Processes

Effective asset management involves structured processes to ensure assets deliver value consistently.

1. Asset Identification

- Catalog all assets with details including type, value, location, condition, and ownership.

2. Asset Valuation and Analysis

- Assess the financial worth, operational importance, and potential risks of each asset.

3. Planning and Acquisition

- Decide which assets to acquire or replace based on strategic goals and budget.

4. Operation and Maintenance

- Implement processes to ensure assets remain functional and productive.

5. Monitoring and Performance Measurement

- Track performance metrics, financial returns, and maintenance effectiveness.

6. Risk Assessment and Mitigation

- Identify potential threats to asset value and develop strategies to minimize risk.

7. Disposal or Renewal

- Retire, sell, or upgrade assets when they reach the end of their lifecycle or no longer meet strategic needs.

Roles in Asset Management

Asset management relies on collaboration among various roles:

- Portfolio Manager / Fund Manager – Oversees financial assets, investment strategy, and risk management.

- Asset Manager (Corporate) – Manages physical or digital assets, maintenance, and lifecycle decisions.

- Risk Manager – Monitors and mitigates risks associated with asset performance.

- Financial Analyst – Evaluates investment performance, market trends, and asset valuation.

- Operations / Maintenance Teams – Responsible for operational efficiency, preventive maintenance, and compliance.

Asset Management Tools

Modern asset management leverages technology to improve efficiency and decision-making. Popular tools include:

- Financial Tools: Bloomberg Terminal, Morningstar Direct, BlackRock Aladdin.

- Physical Asset Tools: IBM Maximo, SAP EAM, Infor EAM.

- Digital Asset Tools: Bynder, Adobe Experience Manager, Widen Collective.

- Analytics and Reporting Tools: Power BI, Tableau, Oracle Analytics.

Benefits of Asset Management

Effective asset management delivers significant benefits:

- Maximized Returns – Optimizing financial portfolios and physical asset utilization improves profitability.

- Risk Reduction – Proactive monitoring and maintenance prevent failures and losses.

- Improved Decision-Making – Data-driven insights inform better investment and operational strategies.

- Cost Efficiency – Minimizes unnecessary expenditures on maintenance, replacements, and downtime.

- Enhanced Compliance – Ensures adherence to legal, financial, and regulatory standards.

- Sustainability – Extends asset lifecycle, reduces waste, and supports environmental goals.

- Operational Excellence – Streamlined processes and clear asset visibility increase productivity.

Challenges in Asset Management

Despite its advantages, asset management faces several challenges:

- Data Accuracy and Management – Maintaining comprehensive, up-to-date records is difficult.

- Technological Integration – Implementing digital asset management systems may be costly and complex.

- Risk of Obsolescence – Assets may become outdated due to market or technological changes.

- Balancing Short-Term and Long-Term Goals – Optimizing for immediate returns versus sustainable growth can conflict.

- Regulatory and Compliance Risks – Failure to comply with financial or operational regulations can have severe consequences.

Asset Management Metrics and KPIs

Tracking performance is essential to effective asset management. Key metrics include:

- Return on Assets (ROA) – Measures financial returns relative to total assets.

- Asset Utilization Rate – Percentage of time an asset is actively contributing to operations.

- Maintenance Costs – Expenses associated with maintaining physical assets.

- Downtime Metrics – Tracks operational disruptions or equipment failure.

- Portfolio Performance – Measures investment returns against benchmarks.

- Risk Metrics – Assesses exposure to market, operational, or technological risks.

Asset Management Strategies

Successful asset management requires strategic planning:

- Diversification – Spread investments across multiple asset classes to reduce risk.

- Preventive Maintenance – Proactively service physical assets to avoid downtime.

- Lifecycle Costing – Analyze total costs from acquisition to disposal to optimize investment.

- Portfolio Rebalancing – Adjust financial asset allocations periodically for optimal returns.

- Digital Transformation – Adopt tools to monitor, analyze, and automate asset management processes.

Real-World Applications of Asset Management

- Financial Services – Investment firms use asset management to maximize returns for clients.

- Infrastructure Management – Cities manage roads, utilities, and buildings to ensure public service efficiency.

- Corporate Asset Management – Companies maintain machinery, IT infrastructure, and intellectual property to support operations.

- Real Estate Management – Asset managers optimize property portfolios for income and appreciation.

- Digital Content Management – Media organizations manage digital files, licensing, and intellectual property.

Common Misconceptions

- Asset Management is Only for Wealthy Individuals – Businesses, governments, and organizations also rely on asset management.

- It’s Only About Financial Investments – Physical and digital assets are equally critical.

- It Guarantees High Returns – Asset management optimizes value but cannot eliminate market or operational risks.

- Tools Alone Ensure Success – Effective strategies and skilled personnel are equally important.

Steps to Implement Asset Management

- Assess Current Assets – Create a detailed inventory and valuation of all assets.

- Define Objectives – Align asset management strategy with organizational goals.

- Choose the Right Framework – Apply financial, physical, or digital asset management practices.

- Implement Technology – Use tools for monitoring, reporting, and analytics.

- Monitor Performance – Track KPIs and metrics regularly.

- Continuously Improve – Review strategies and adjust based on outcomes and feedback.

Future of Asset Management

The future of asset management is shaped by technology, sustainability, and data-driven decision-making:

- AI and Predictive Analytics – Optimizing portfolio performance and asset maintenance.

- IoT Integration – Smart sensors track asset conditions in real-time.

- Sustainable Investing – Environmental, Social, and Governance (ESG) considerations guide investment decisions.

- Digital Transformation – Automation and cloud-based solutions streamline asset management workflows.

- Globalization – Managing assets across borders requires advanced compliance and risk strategies.

Conclusion

Asset management is a vital discipline that ensures organizations and individuals maximize the value of their assets. Whether dealing with investments, physical infrastructure, or digital resources, effective asset management balances risk, cost, and performance while aligning with long-term strategic goals. By adopting a systematic approach, leveraging technology, and focusing on continuous improvement, organizations can enhance operational efficiency, safeguard resources, and achieve sustainable growth.