Executive Summary

Revenue Cycle Management (RCM) is a comprehensive process that healthcare organizations and businesses use to manage the financial aspects of patient care or service delivery—from initial engagement to final payment. RCM ensures accurate billing, timely reimbursement, regulatory compliance, and effective cash flow management.

In healthcare, RCM encompasses the administrative and clinical functions that contribute to capturing, managing, and collecting revenue. In other industries, it may apply to managing the sales and payment process efficiently. Effective RCM maximizes revenue, reduces claim denials, improves patient satisfaction, and ensures operational efficiency.

This guide explores the concept, processes, stages, benefits, challenges, strategies, tools, and emerging trends in Revenue Cycle Management, providing a thorough understanding for healthcare administrators, business managers, and financial professionals.

Table of Content

Introduction

Revenue Cycle Management is the backbone of financial operations for healthcare providers, insurance companies, and service-based businesses. It integrates administrative, clinical, and financial tasks to ensure organizations are reimbursed for the services they deliver.

RCM is not limited to billing; it involves the entire lifecycle of revenue—from patient registration, insurance verification, clinical documentation, charge capture, claim submission, payment posting, to accounts receivable follow-up.

In today’s highly regulated environment, effective RCM is critical. Healthcare providers, for example, must comply with insurance requirements, government regulations, and industry standards while ensuring patients are not overcharged or underserved.

Core Concepts of Revenue Cycle Management

- Patient Registration and Scheduling – Capturing accurate demographic, insurance, and contact information.

- Insurance Eligibility and Verification – Confirming patient coverage and co-pay obligations before services are rendered.

- Charge Capture – Documenting services provided for billing purposes.

- Medical Coding – Assigning standardized codes (ICD-10, CPT, HCPCS) to procedures and diagnoses.

- Claim Submission – Sending claims to payers for reimbursement.

- Payment Posting – Recording payments received from patients and insurance providers.

- Denial Management – Identifying, analyzing, and resolving rejected claims.

- Accounts Receivable Follow-Up – Ensuring timely payment collection.

- Reporting and Analytics – Monitoring financial performance, identifying trends, and supporting strategic decisions.

Key Stages of Revenue Cycle Management

1. Pre-Registration and Patient Intake

- Collecting personal, insurance, and contact information.

- Scheduling appointments and confirming eligibility.

- Reducing errors at the entry point to prevent claim denials.

2. Insurance Verification

- Confirming the patient’s coverage, co-pay, deductibles, and prior authorization requirements.

- Minimizing surprise bills and delayed payments.

3. Charge Capture

- Documenting every service or procedure provided.

- Ensuring accurate coding and preventing revenue loss due to underbilling.

4. Coding and Billing

- Translating medical services into standardized codes.

- Preparing accurate claims for insurance submission.

- Applying compliance checks to reduce audit risks.

5. Claim Submission

- Sending electronic or paper claims to payers.

- Monitoring claim status and correcting errors proactively.

6. Payment Posting and Reconciliation

- Recording payments received from insurance and patients.

- Reconciling accounts to ensure all services are appropriately compensated.

7. Denial Management and Appeals

- Investigating reasons for claim denial (coding errors, eligibility issues, missing documentation).

- Submitting appeals and resubmitting corrected claims.

8. Accounts Receivable Management

- Tracking unpaid claims and outstanding balances.

- Communicating with payers and patients to ensure timely collection.

9. Reporting and Financial Analytics

- Analyzing revenue trends, denials, and outstanding accounts.

- Supporting strategic planning and operational improvement.

Related Topics to Explore

Revenue Cycle Management (RCM) ties closely to other essential business and operational systems that help organizations maintain efficiency, financial accuracy, and workforce productivity.

Explore these related guides to strengthen your understanding of integrated management processes:

- What Is Operations Management? – Understand how effective process control and optimization support smoother financial and operational cycles.

- What Is Business Management? – Learn how strong management practices enhance organizational strategy and revenue outcomes.

- What Is Performance Management? – Explore how monitoring and improving employee performance impacts overall financial results.

- What Is Case Management? – Discover how structured case handling contributes to improved client services and billing accuracy.

- What Is Human Capital Management (HCM)? – See how managing workforce effectiveness supports smoother financial and operational performance.

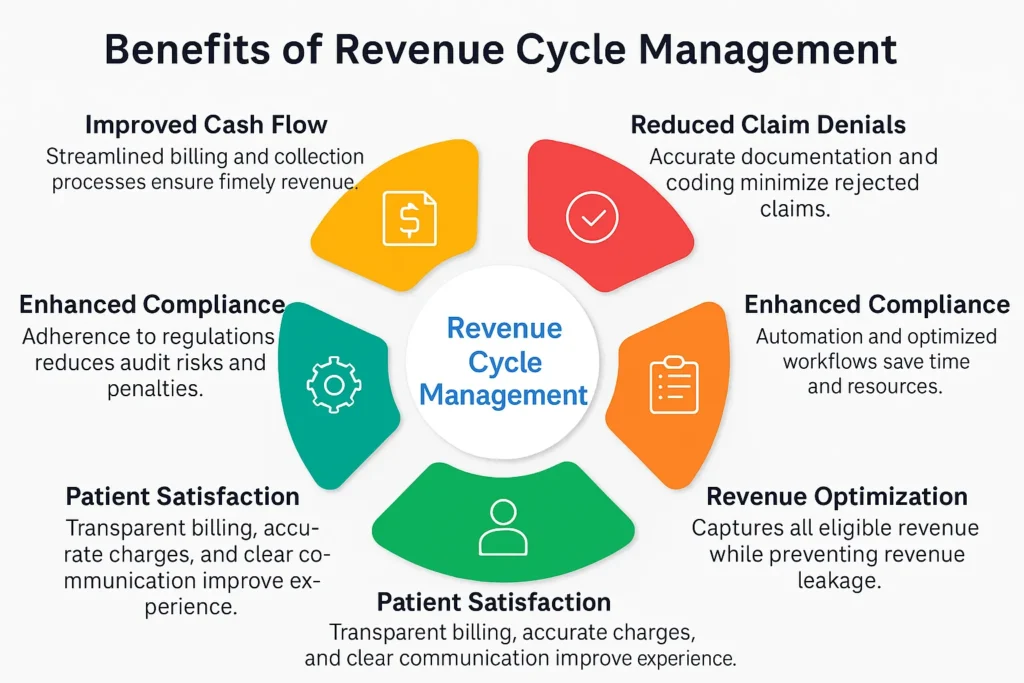

Benefits of Revenue Cycle Management

- Improved Cash Flow – Streamlined billing and collection processes ensure timely revenue.

- Reduced Claim Denials – Accurate documentation and coding minimize rejected claims.

- Enhanced Compliance – Adherence to regulations reduces audit risks and penalties.

- Operational Efficiency – Automation and optimized workflows save time and resources.

- Patient Satisfaction – Transparent billing, accurate charges, and clear communication improve experience.

- Data-Driven Decision-Making – Financial analytics support strategic planning and cost control.

- Revenue Optimization – Captures all eligible revenue while preventing revenue leakage.

Revenue Cycle Management Strategies

- Front-End Optimization – Ensuring accurate patient registration, eligibility verification, and pre-authorization.

- Coding Accuracy and Compliance – Training coders and leveraging automated coding tools.

- Automated Claim Submission – Reducing errors and speeding up reimbursement.

- Denial Prevention and Management – Implementing proactive monitoring and timely follow-up on denials.

- Accounts Receivable Monitoring – Regularly reviewing outstanding balances and prioritizing collections.

- Patient Financial Engagement – Educating patients on co-pays, deductibles, and payment options.

- Revenue Analytics – Using KPIs and dashboards to monitor performance, identify trends, and adjust processes.

Tools and Technologies in Revenue Cycle Management

- Electronic Health Records (EHR): Epic, Cerner, Allscripts

- Practice Management Software: Athenahealth, Kareo, NextGen

- Revenue Cycle Management Platforms: R1 RCM, Optum360, MedAssets

- Coding and Compliance Tools: 3M CodeFinder, TruCode, EncoderPro

- Denial Management Solutions: Experian Health Denial Management, ZirMed

- Payment Processing Tools: PatientPay, Square, Stripe Healthcare Solutions

- Analytics and Reporting Tools: Tableau, Power BI, Qlik for financial insights

- Automated Workflows: Robotic Process Automation (RPA) to speed claim processing

Challenges in Revenue Cycle Management

- Complex Regulatory Environment – Compliance with HIPAA, CMS guidelines, and payer rules.

- Claim Denials and Rejections – Errors in documentation, coding, or eligibility verification.

- Patient Payment Delays – High deductibles and co-pays leading to slower payments.

- Data Accuracy – Incomplete or inaccurate information at registration or documentation stages.

- Technology Integration – Difficulty in connecting EHR, billing, and RCM systems.

- Revenue Leakage – Missed charges, underbilling, or delayed claims reducing revenue.

- Staff Training and Retention – Skilled RCM professionals are in high demand.

Key Metrics and KPIs

- Days in Accounts Receivable (AR) – Average time to collect payment.

- Claim Denial Rate – Percentage of claims denied by payers.

- First-Pass Resolution Rate – Claims approved and paid without rework.

- Net Collection Rate – Percentage of total potential revenue successfully collected.

- Patient Payment Collection Rate – Amount collected directly from patients.

- Cost to Collect – Expenses incurred in managing RCM relative to revenue collected.

- Revenue Leakage Rate – Percentage of revenue lost due to errors or inefficiencies.

Real-World Applications

- Hospitals and Healthcare Systems – Managing billing, claims, and reimbursements for inpatient and outpatient services.

- Physician Practices – Optimizing small practice revenue through accurate coding and collections.

- Insurance Companies – Processing claims, verifying eligibility, and managing provider payments.

- Long-Term Care Facilities – Streamlining RCM for complex patient care and insurance coverage.

- Dental and Specialty Clinics – Capturing revenue for specialized procedures and services.

- Telehealth Services – Managing claims for virtual care appointments.

Common Misconceptions

- RCM is Only About Billing – It includes pre-service, service, and post-service financial management.

- Technology Alone Solves RCM Challenges – Skilled staff and proper processes are equally critical.

- Denials are Unavoidable – Proactive verification, coding, and workflow management reduce denials.

- RCM is Only for Hospitals – Any service-based organization can benefit from revenue cycle optimization.

Future of Revenue Cycle Management

- Artificial Intelligence (AI) and Machine Learning – Predictive analytics for claim approvals and denials.

- Automation and RPA – Reducing manual entry, speeding claim processing, and improving accuracy.

- Patient Financial Engagement Tools – Offering payment plans, digital portals, and transparent billing.

- Cloud-Based RCM Solutions – Enhancing accessibility, scalability, and security.

- Data-Driven Decision-Making – Leveraging analytics to optimize revenue, reduce denials, and monitor trends.

- Telehealth Integration – Incorporating virtual care billing and reimbursement processes.

- Regulatory Compliance Adaptation – Staying updated with evolving healthcare and payer regulations.

Conclusion

Revenue Cycle Management is a critical component of financial stability for healthcare organizations and service-based businesses. It encompasses a series of interconnected processes—from patient registration, insurance verification, and coding to claims submission, denial management, and payment collection. Effective RCM ensures accurate billing, maximizes revenue, reduces claim denials, maintains compliance, and improves patient satisfaction.

With advancements in technology, data analytics, automation, and patient engagement strategies, RCM continues to evolve, helping organizations optimize cash flow and operational efficiency. Understanding and implementing best practices in Revenue Cycle Management is essential for financial success and sustainable growth in today’s competitive and complex healthcare and business environments.