What will you in QuickBooks Online for Beginners: Small Business & Bookkeeper Course

- Understand the basics of QuickBooks Online and its features.

- Learn how to set up a company profile and navigate the QuickBooks interface.

- Gain insights into managing transactions, including invoicing and payments.

- Learn how to reconcile accounts and generate reports.

- Apply advanced features like inventory tracking and tax management.

Program Overview

Module 1: Introduction to QuickBooks Online

⏳ 30 minutes

Overview of QuickBooks Online and its benefits.

Setting up a company profile and understanding the dashboard.

Basic navigation tips for QuickBooks Online.

Module 2: Managing Transactions

⏳ 45 minutes

How to record and categorize income and expenses.

Creating and sending invoices to customers.

Managing bills and payments from suppliers.

Module 3: Banking and Reconciliation

⏳ 45 minutes

Connecting bank accounts to QuickBooks Online.

Categorizing and matching transactions.

Reconciling bank accounts and fixing discrepancies.

Module 4: Reports and Financial Statements

⏳ 45 minutes

Generating key financial reports: Profit & Loss, Balance Sheet, etc.

Understanding the information these reports provide.

Customizing reports for your business needs.

Module 5: Advanced Features

⏳ 45 minutes

Managing inventory and tracking items.

Setting up payroll and handling employee expenses.

Using QuickBooks Online for tax management and preparation.

Get certificate

Job Outlook

QuickBooks skills are highly valued in small businesses and accounting firms.

Bookkeepers and accountants with QuickBooks Online experience can earn between $40K and $60K annually, with the potential for career growth in senior accounting roles.

Many professionals transition into freelance bookkeeping or tax consulting roles.

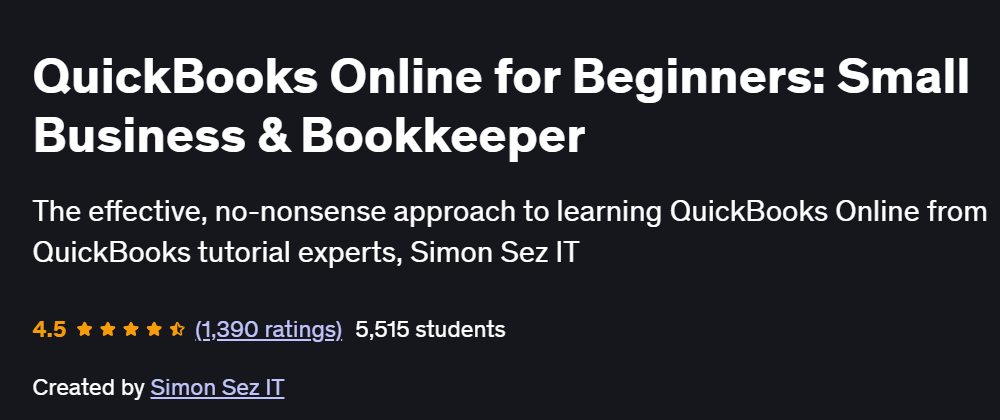

Specification: QuickBooks Online for Beginners: Small Business & Bookkeeper

|