What you will learn in Stock Market Investing for Beginners Course

Learners will understand the basic concepts of the stock market, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

The course covers how the stock market operates, including how stocks are traded and the role of exchanges like the NYSE and NASDAQ.

Students will explore the different types of stocks and how to analyze them for potential investment opportunities.

- The course teaches how to read financial statements, understand company valuations, and make informed decisions.

- Learners will gain insights into risk management, portfolio diversification, and strategies for long-term investing.

Program Overview

Introduction to the Stock Market

⏳ 2-4 weeks

- Understand the fundamentals of the stock market and its role in the economy.

- Learn the key terms and concepts, such as stocks, bonds, dividends, and market orders.

- Explore how the stock market functions, including how stocks are bought and sold on exchanges.

Types of Investments

⏳ 4-6 weeks

- Learn about the different types of stocks (growth, value, dividend) and other investment vehicles like bonds and ETFs.

- Study how to assess the potential risk and reward of different investment types.

- Understand the importance of building a diversified portfolio to manage risk and maximize returns.

Stock Market Terminology & Trading Mechanisms

⏳ 4-6 weeks

- Discover common stock market terminology and how to use it effectively in your investing strategy.

- Understand how to place market and limit orders, as well as the different types of trading (e.g., day trading, swing trading, long-term investing).

- Learn about stock indices, such as the S&P 500, and how they reflect the performance of the market.

Analyzing Stocks & Financial Statements

⏳ 4-6 weeks

Learn how to analyze a company’s financial health by reading balance sheets, income statements, and cash flow statements.

Study key financial ratios (P/E ratio, EPS, etc.) to evaluate a company’s profitability and growth potential.

Explore different valuation methods for determining if a stock is overvalued or undervalued.

Risk Management & Diversification

⏳6-8 weeks

Understand the concept of risk and how to mitigate it through portfolio diversification.

Learn how to balance high-risk and low-risk investments to achieve your financial goals.

Study the importance of rebalancing your portfolio periodically and adjusting it based on market conditions.

Building an Investment Strategy

⏳ 4-6 weeks

Learn how to set financial goals and develop an investment strategy tailored to your needs and risk tolerance.

Explore various investing strategies, such as value investing, growth investing, and dividend investing.

Study how to allocate assets across different investment types to create a balanced portfolio.

Final Project: Creating Your Own Investment Plan

⏳ 6-8 weeks

- Apply the concepts learned throughout the course to create your own personalized investment plan.

- Identify your risk tolerance, set investment goals, and choose stocks and other investments for your portfolio.

- Present your investment plan for feedback and make adjustments as needed.

Get certificate

Job Outlook

- Knowledge of the stock market is highly valuable for careers in finance, investment banking, wealth management, and financial analysis.

- Investment professionals can expect salaries ranging from $60K to $90K for entry-level roles, with experienced professionals earning $120K+ in senior positions.

- Understanding stock market investing is also beneficial for personal financial planning and wealth-building.

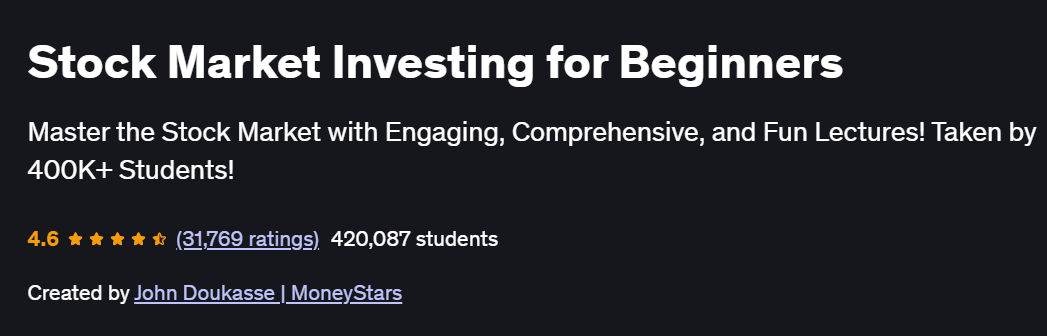

Specification: Stock Market Investing for Beginners

|

FAQs

- You can start with a small amount; some brokers allow investments as low as $50–$100.

- Fractional shares let you buy parts of expensive stocks.

- Small investments let you practice and learn without significant financial risk.

- Consistency and habit are more important than initial capital.

- Start with well-known, stable companies (blue-chip stocks).

- Look for companies with steady earnings and growth potential.

- Avoid speculative stocks initially; focus on long-term performance.

- Use stock screeners or broker recommendations to simplify choices.

- Investing is research-driven, while gambling is based on luck.

- Diversifying your portfolio reduces risk.

- Long-term investing strategies generally provide more predictable returns.

- Using stop-losses and informed decisions helps minimize losses.

- Yes, investing can be part-time.

- Long-term investment strategies need minimal daily monitoring.

- Mobile apps make it easy to track your portfolio on the go.

- Automated or recurring investments help maintain consistency.

- Capital gains tax may apply to profits from selling stocks (rates vary for short-term vs. long-term).

- Dividend income may also be taxable depending on your jurisdiction.

- Keeping trade records simplifies tax reporting.

- Consulting a tax advisor ensures compliance and prevents mistakes.